Today, companies are expected to report on their non-financial (ESG) performance. Investors and regulators are increasingly assessing companies based on their ESG performance.

Business is investing in ESG as a way to identify risks, impacts and responses that sustain growth. Non-financial performance now has a financial consequence.

We have worked with international partners to develop the Global ESG Monitor (GEM), a unique study that examines transparency in non-financial reporting by many of the largest companies in the world.

The goal is to help companies provide better ESG reporting for their stakeholders. Transparency is measured using the GEM Assay™, a research tool developed specifically for this purpose.

The GEM Assay™ is based on the relevant guidelines of Global Reporting Initiative (GRI), ISO Standard 26000, World Economic Forum and Accountability and Transparency, 2010a.

This year, the Global ESG Monitor has expanded. The companies in the sample have increased from 140 in 2021 to 350 in 2022. The questions cover more topics on more questions, ranging from the planet and people to prosperity and governance. The scoring model now covers 175 data points, rather than the 66 of last year, and points are adjusted to be out of 100.

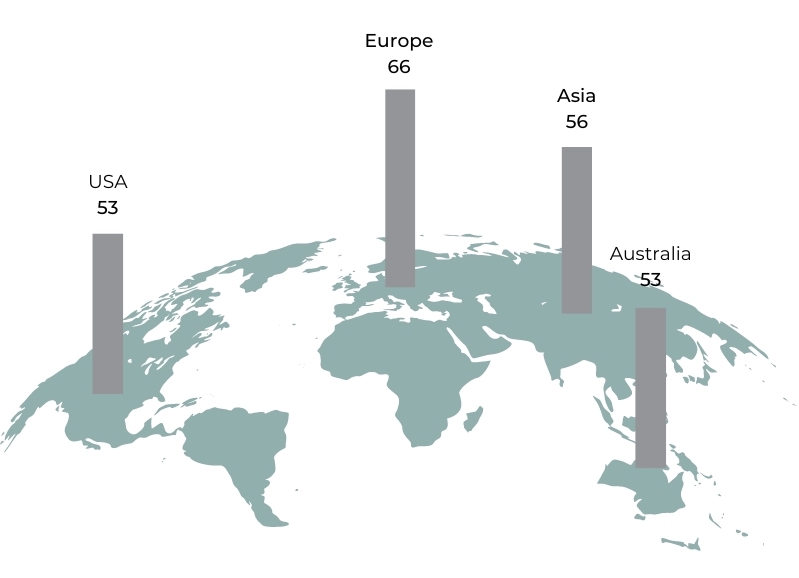

European companies are global leaders for ESG transparency on climate action, with seven of the top ten companies being from Europe. Italian company Enel SpA is world's best for transparency in ESG reporting, scoring a 90 out of 100 points. The average score for the companies analysed in Europe was far ahead of other regions at 66 points, followed by Asia at 56 points, and the USA at 53 points.

Comparatively, the Australians lagged behind, sitting at joint last with USA with 53 points. In particular, the Australian sample performed poorly around its reporting of natural resource impacts. Australian companies also have the lowest percentage of companies that report KPIs for managing sustainability.

Endeavour Group ranked highest among Australian companies with a score of 76 points, followed by Newcrest Mining and Australian and New Zealand Banking Group (73 points).